Are you confident you can maintain your lifestyle during retirement?

Clients We Serve

Serving clients in historic Concord Massachusetts and beyond, including fifteen states and three countries. We work with a broad range of clients both virtually and in person to facilitate their journey to financial independence.

Life Transitions

Life is far from predictable, so we provide clients with thoughtful recommendations to bring certainty in times of change like selling a business, retirement, inheritance, divorce, or the loss of a spouse.

Executives & Entrepreneurs

Business leaders have unique needs from diversifying concentrated stock to retirement planning to advanced tax requirements, and more. Integrated financial planning helps them meet their objectives and build a path forward.

Late Career & Retirees

Retirement is one of the largest savings goals of your life. It’s important to have a comprehensive plan that takes your cash flow, investments, health, taxes, and lifestyle needs into account. Our team can help prepare you for that transition and create a plan that enhances your life.

Trust & Inheritance

Your legacy should embody your vision and values. We can help you develop a comprehensive plan that takes your needs into account whether that be establishing the right trust, building an inheritance plan or donating to charity.

How Can We Help You?

We can work together in one of two ways

Financial Planning

Project‐based planning for a one‐time fee and a defined timeframe that could answer the following questions. Can you maintain lifestyle in retirement? Are you ready to retire?

Our financial planning-centric approach puts you at the center of the relationship. During the planning process, we consider each of your objectives as part of a bigger, interrelated picture and then partner with you to build a plan to achieve what matters most to you.

Estate Planning

Education Funding

Cash Flow Projections

Retirement Planning

Portfolio Risk & Return Assessment

Risk Management

Tax Planning

As fiduciary advisors, we are obligated to put your interests ahead of our own. We are fee-only advisors meaning the only compensation we receive is from our clients. We do not receive commissions based on products or referrals.

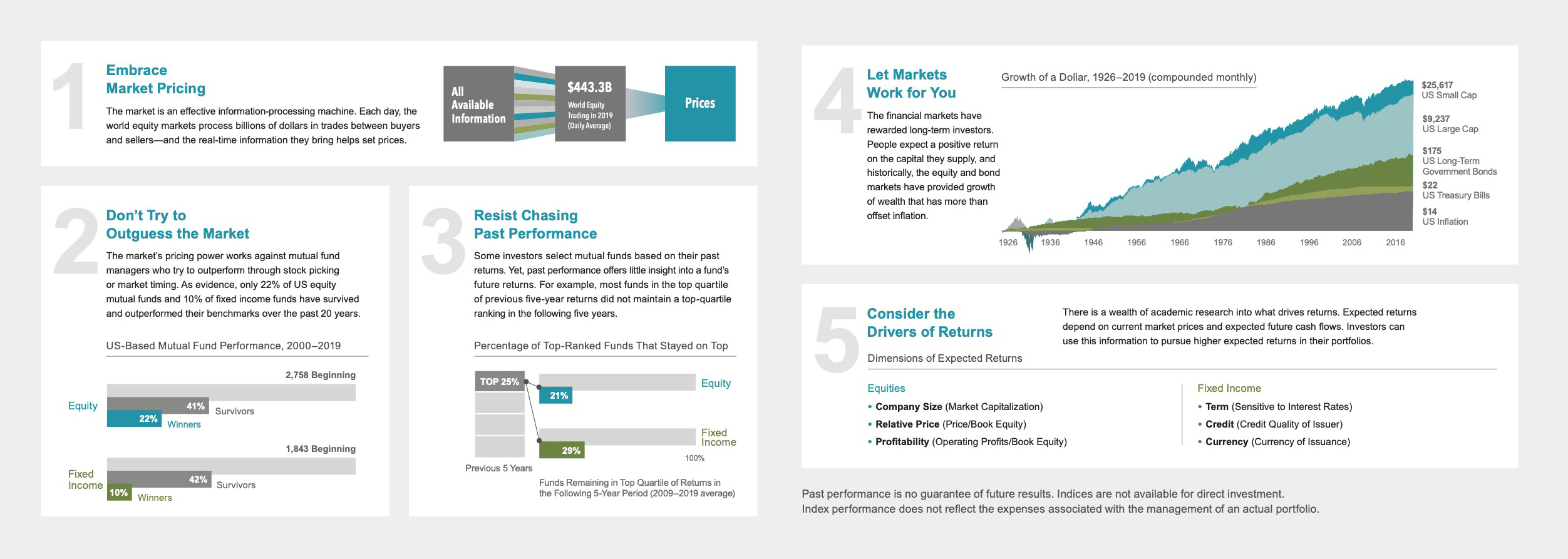

Disciplined Investment Strategy via Master Planning

Welcome to The Monument Group Companies

We offer an integrated suite of services through our affiliated firms listed below including wealth management, estate planning, trust administration, and tax services. Whether you work with our in‐house team or bring in outside professionals, you can have confidence that the financial plan we build together will be implemented according to the plan.

Published In

Receive Email Updates

Sign up to receive blog posts, firm announcements and financial tips